Amazon Sellers Face New Address Verification Rules

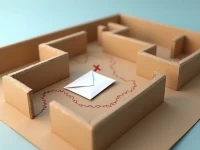

This article addresses the address verification challenges faced by Amazon sellers. It details the standard postcard verification process and offers various strategies for dealing with reception issues, including communicating with couriers, using errand services for signature, proactively picking up the postcard, and modifying the address in the Amazon backend. The article also analyzes the potential risks associated with each strategy, aiming to help sellers effectively resolve address verification problems and ensure smooth store operations. It provides practical advice and insights to navigate the complexities of Amazon's address verification system.