Amazon FBM Sellers Risk Suspension for Unshipped Orders in Peak Season

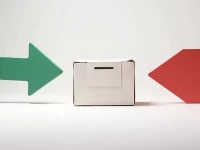

An Amazon FBM seller's store was deactivated due to untimely order processing. During peak seasons, prioritizing account security and compliant operations is crucial. The FBM model presents both opportunities and challenges, requiring careful consideration. Sellers should proactively manage their order fulfillment and adhere to Amazon's policies to avoid account suspension, especially during high-volume periods. Maintaining good standing with Amazon is essential for long-term success in the FBM business model. Careful planning and execution are key to navigating the complexities of peak season and ensuring continued operation.