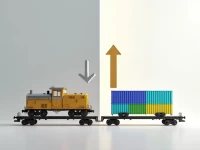

Entrepreneur Launches Export Business with 3000 Investment

This article explores how to start a solo foreign trade business with a starting capital of 3000 RMB. It emphasizes the importance of product selection strategy, fund allocation, customer development, and supply chain management. The article points out that in the initial stage, the focus should be on validating the business model rather than pursuing profits. Through refined operations and continuous accumulation, long-term and stable development of solo foreign trade can be achieved.