As global supply chains pulse with economic fluctuations, rail freight volumes serve as a crucial barometer of economic health. Recent data from the Association of American Railroads (AAR) reveals a nuanced picture of the U.S. rail freight market for the week ending March 21, with traditional freight experiencing modest declines while intermodal transportation demonstrates growth. This divergence reflects ongoing structural adjustments in the U.S. economy and signals potential transformations in logistics models.

Traditional Freight: Moderate Declines with Bright Spots

Total U.S. rail freight volume reached 284,618 carloads during the reported week, marking a 2.4% year-over-year decrease. Despite this overall softness, three of the ten major commodity categories tracked by AAR showed positive growth. Grain transportation stood out with a 21.9% increase to 24,087 carloads, likely driven by rising global food demand, increased U.S. agricultural exports, and rail's advantages in long-distance bulk transport. Automotive shipments also grew by 6.7% to 18,765 carloads, indicating recovery in the auto industry and strengthening consumer demand.

The weekly data shows improving momentum compared to previous weeks, with March 21 volumes exceeding the 278,856 carloads recorded on March 14 and significantly higher than the 268,820 and 267,060 carloads reported on March 7 and February 28 respectively. This sequential improvement demonstrates the resilience of U.S. rail freight despite economic headwinds.

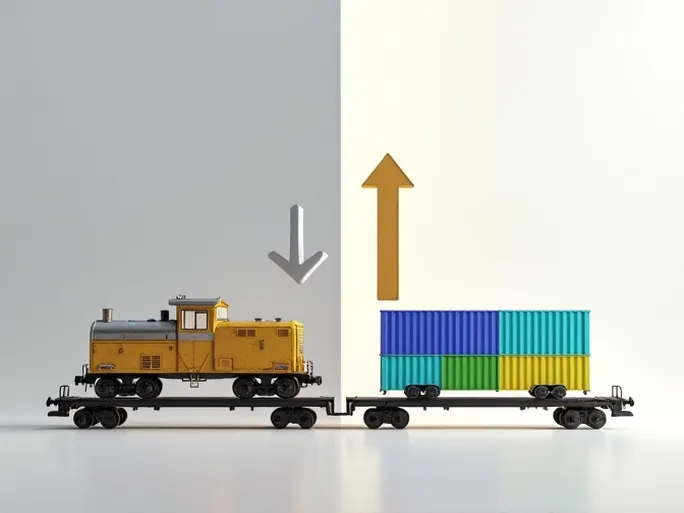

Intermodal: Strong Growth Signals Shift in Logistics

In contrast to traditional freight, intermodal transportation posted robust growth of 6.7% year-over-year to 277,854 containers and trailers. This performance exceeded the previous week's 274,125 units and far surpassed the 253,762 and 241,958 units recorded in earlier weeks. The intermodal expansion reflects businesses' growing preference for efficient, flexible logistics solutions and rail's competitive advantages in long-haul transportation and multimodal connectivity.

This growth coincides with significant U.S. government investments in infrastructure modernization, including rail networks, ports, and highways. The rapid expansion of e-commerce has further accelerated intermodal adoption as consumers demand faster, more reliable delivery services.

Year-to-Date Performance: Mixed Results

Cumulative data through March 21 shows U.S. rail freight volume up 0.9% to 3,082,147 carloads, while intermodal volumes declined 0.4% to 2,740,254 units. These figures suggest that while intermodal shows promising weekly growth, it continues to face annualized challenges.

The rail freight sector confronts both opportunities and obstacles moving forward. Global economic uncertainty, trade policy shifts, and geopolitical risks may suppress demand, while technological innovation could enhance rail efficiency and service capabilities. Rail operators must invest in infrastructure, optimize operations, improve service quality, and explore new business models to maintain competitiveness. Strengthening partnerships with other transportation modes will be crucial for developing sustainable logistics ecosystems.

Conclusion: Transformation Underway

The U.S. rail freight market stands at an inflection point, with traditional freight facing growth constraints while intermodal demonstrates significant potential. Rail operators embracing innovation and operational improvements will be best positioned to compete effectively and maintain rail's vital role in America's transportation infrastructure and economic prosperity.