Saudi National Bank Releases SWIFT Codes for All Branches

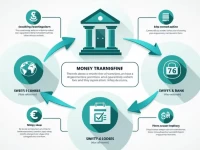

This article provides a comprehensive list of SWIFT codes for branches of the National Bank of Saudi Arabia, assisting you in making international remittances easily. It also offers solutions in case you cannot find a branch code, ensuring the safe arrival of funds.