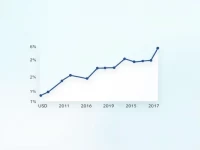

SGD to USD Exchange Rate Trends Impact Investments

This article analyzes the exchange rate trends of the Singapore dollar (SGD) against the US dollar (USD), with the current exchange rate at 1 SGD = 0.778391 USD, reflecting a 3.22% increase over the past year. By presenting details of the exchange rate and both currencies, it explores how investors can utilize exchange rate dynamics to optimize their investment decisions.