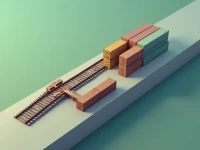

US Rail Freight Volumes Drop Amid Economic Slowdown

The Association of American Railroads reported a significant year-over-year decrease in U.S. rail freight and intermodal traffic for the week ending September 12th. This decline was influenced by Labor Day and substantial drops in carloads of metallic ores and petroleum products. Year-to-date figures show a decrease in carload traffic but a slight increase in intermodal volume. Railroad companies should pay close attention to the global economic situation, diversify their business portfolio, improve operational efficiency, and proactively respond to the energy transition.