The latest data from the Association of American Railroads (AAR) reveals a notable downturn in U.S. rail freight and intermodal volumes during the week ending November 30, with analysts attributing the decline primarily to Thanksgiving holiday disruptions.

Sharp Decline in Freight Volumes

U.S. rail freight volumes plummeted 19.9% year-over-year to 189,746 carloads during the reported week. This represents a significant drop from the previous two weeks' figures (230,036 carloads for November 23 and 223,659 carloads for November 16). The pronounced decrease aligns with typical holiday patterns, as many businesses reduce or suspend operations during Thanksgiving week.

Commodity-Specific Impacts

The AAR's commodity breakdown shows divergent sector performance:

• Coal shipments fell most dramatically (-16,218 carloads to 52,126)

• Non-metallic minerals declined by 8,469 carloads to 20,496

• Metallic ores and metals decreased by 5,821 carloads to 15,991

Miscellaneous freight bucked the trend with a modest 236-carload increase to 7,833, suggesting selective demand resilience in certain niches.

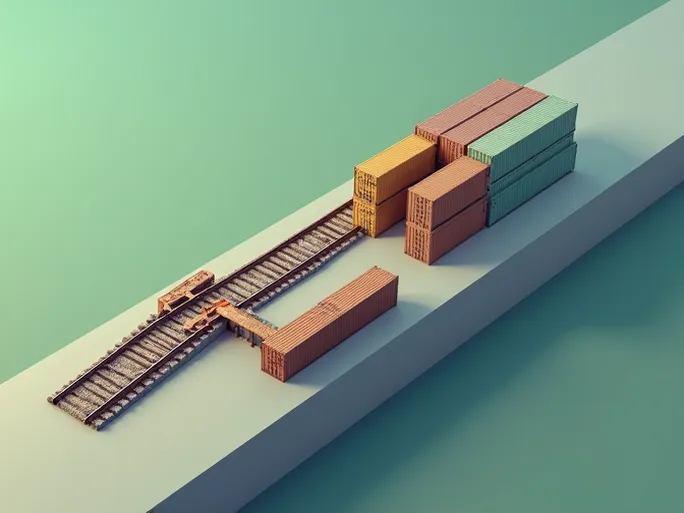

Intermodal Shows Relative Resilience

Intermodal units (containers and trailers) declined 8.5% year-over-year to 249,616, demonstrating shallower contraction than rail freight. The comparative stability suggests intermodal may offer greater operational flexibility during holiday disruptions.

Year-to-Date Performance

Cumulative data through 48 weeks of 2024 presents a mixed picture:

• Total rail freight: 10,468,228 carloads (-3.1% year-over-year)

• Intermodal volume: 12,749,686 units (+9.1% year-over-year)

The divergent trends highlight structural shifts in transportation preferences, with intermodal gaining market share despite broader freight challenges.

Economic Context and Outlook

Industry analysts caution against overinterpreting single-week data, noting that holiday-related fluctuations typically normalize post-Thanksgiving. However, the full-year trends reflect deeper economic dynamics:

• Coal's continued decline mirrors energy transition pressures

• Intermodal growth signals logistics optimization trends

• Mixed commodity performance indicates sector-specific demand variations

The rail sector faces competing pressures from economic uncertainty and sustainability initiatives, while simultaneously benefiting from intermodal expansion and operational innovations.