Bounce Curl Sues Over Comb Patent Ecommerce Sellers at Risk

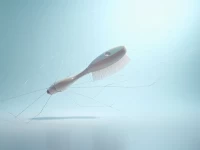

GBC Law Firm is representing Bounce Curl in a comb infringement case, reminding cross-border e-commerce sellers to pay attention to intellectual property protection. The case involves Bounce Curl's comb products. Sellers should self-check their store products to avoid infringement risks and strengthen their awareness of intellectual property protection. This case highlights the importance of verifying product authenticity and ensuring compliance with intellectual property laws to avoid potential legal repercussions for online retailers selling globally.