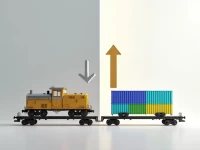

North American Intermodal Growth Rises on Domestic Container Demand

The Intermodal Association of North America (IANA) reports a 4.5% year-over-year increase in North American intermodal volume in Q1, with domestic container shipments leading the growth. Lower fuel costs, improved service, and railway investments are key drivers. Experts note that transloading and base effects also contribute. International container growth exceeded expectations, while trailer volume decline narrowed. Intermodal marketing companies saw revenue growth despite lower loadings. The outlook for the intermodal market is positive, suggesting opportunities for businesses to capitalize on the momentum.