Papua New Guinea Banking Adopts Efficient International Payment Systems

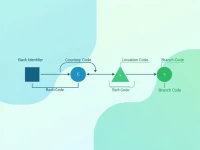

This report analyzes the significance of Papua New Guinea banks in handling international payments, particularly the application of SWIFT codes. It provides methods for locating bank branches and SWIFT codes, assisting users in ensuring accurate fund transfers. Additionally, it emphasizes the importance of compliance and security, helping clients minimize risks in international remittances.