Iran Import Customs Clearance Regulation The Importance of Payment Verification

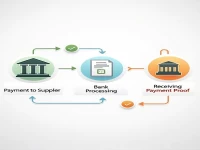

Iranian importers must make payments to suppliers through banks under the company name and provide proof of payment to complete customs clearance. Due to U.S. sanctions, many banks refuse to accept payments from Iran, increasing transaction risks. It is advisable to ensure that payments are received before shipping and to avoid trading in products subject to sanctions to safeguard the supply chain.