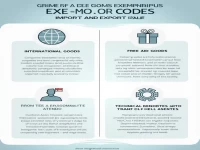

Comprehensive Analysis of Customs Duty Exemption Code

The Customs Tax Exemption Code System provides structured information for managing tax reductions and exemptions. The article analyzes the classification and definitions of exemption types, including general taxation, gratuitous assistance, and specific tax exemptions, each corresponding to different customs codes. These codes help identify and classify import and export goods, facilitating tax processes and supporting trade efficiency. Understanding these codes allows professionals to effectively navigate the complexities of the international trade environment.