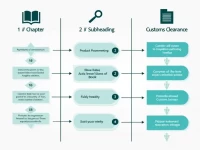

WCO Standards Accelerate Global Trade Digitalization

The Secretary General of the World Customs Organization (WCO) highlighted the crucial role of data and technology in driving the global digital transformation of trade at the ICC Future Trade Forum, introducing relevant WCO initiatives. He advocated for the adoption of the WCO Data Model to promote interoperability of trade standards and explored collaboration opportunities with Singapore Customs, the International Chamber of Commerce, and APEC. The aim is to enhance trade efficiency, security, and inclusivity through standardized data and technological advancements in customs procedures and international trade.