ATA Carnet Simplifies International Trade Processes

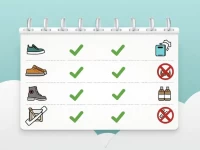

The ATA Carnet is an international customs document that allows goods to be temporarily imported tax-free and duty-free for up to one year. It simplifies customs procedures and is applicable to a variety of items such as exhibitions and professional equipment.