Legal Regulations and Importance of Shipping Marks

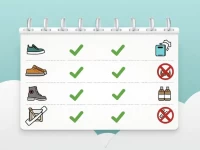

Marks are identifiers in international trade that facilitate the recognition of goods, typically consisting of model numbers, graphics, consignee details, and destination ports. They are crucial during transportation, as ensuring document consistency with the actual goods aids in smooth customs clearance.