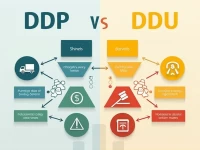

Guide to DDP Shipping in Crossborder Ecommerce

This article provides a comprehensive analysis of various transportation modes for DDP (Delivered Duty Paid) international logistics, including international express, air freight, sea freight, and rail transport. It details the advantages, disadvantages, and applicable scenarios of each mode, offering practical guidance for cross-border e-commerce sellers to choose the appropriate logistics solution. This aims to help them efficiently and conveniently conduct global business. The article focuses on helping sellers understand the nuances of each method to optimize their shipping strategies.