New DDP Shipping Eases International Trade Logistics

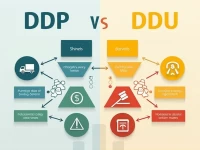

DDP (Delivered Duty Paid) with customs clearance and taxes included is a convenient international trade method. The seller assumes all responsibilities and costs until the goods are delivered to the buyer's specified location, including customs clearance and taxes. It simplifies the process and reduces risk, making it suitable for buyers lacking customs clearance experience or those who want to control costs. Choosing a reputable freight forwarder and understanding the destination country's policies are crucial for successful DDP shipping.