New Zealand Doortodoor Shipping Expands for Oversized Items

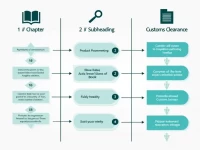

New Zealand sea freight DDP line for large items offers a one-stop, door-to-door service, eliminating complicated customs clearance and delivery procedures. Transparent pricing includes sea freight, customs clearance fees, and delivery charges. Flexible customization is available to meet the transportation needs of various types, sizes, and weights of goods. Customers are advised to pay attention to cargo packaging, accurate declaration, and purchase shipping insurance to ensure cargo safety. This dedicated line simplifies the process of shipping bulky items to New Zealand.