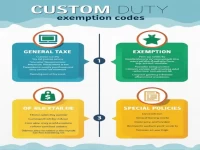

Customs Duty Exemption Code Explained: A Comprehensive Guide to Tax Reductions

This article provides a detailed analysis of the classification and applicability of customs exemption codes. It covers various policies including general taxation, non-repayable aid, and specific regions such as bonded areas, offering a comprehensive understanding of tax management for imported and exported goods. The discussion delves into special policies for imported equipment related to technological upgrades, research projects, and disaster relief donations, aiming to assist enterprises in reducing costs and enhancing market competitiveness.