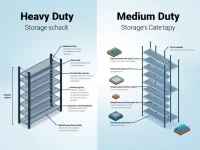

Warehouse Efficiency: Choosing Between Heavy-Duty and Medium-Duty Storage Racks

Heavy and medium storage racks each have unique characteristics; the former is suitable for high load capacity and space utilization, while the latter focuses on flexibility and ease of use. Choosing the right storage rack requires attention to load capacity and safety to avoid overload and improper operations, thereby improving storage efficiency and ensuring personal safety. Understanding the differences between these two types of storage racks will help you make informed warehouse management decisions.