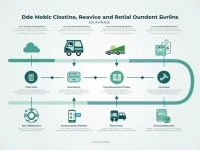

Global Trade Boosted by Delivered Duty Unpaid Shipping

DDP (Delivered Duty Paid) service simplifies cross-border logistics, where the seller handles customs clearance and duties, and the buyer simply receives the goods. This service reduces risks and offers transparent costs, making it suitable for various industries such as electronics and apparel. It helps businesses expand into global markets by streamlining the international shipping process and providing a hassle-free experience for the buyer. This all-inclusive approach simplifies international trade and promotes business growth.