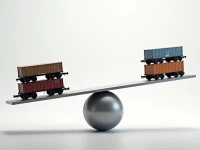

US Rail Freight Mixed As Carload Rises Offset Intermodal Drop

According to the Association of American Railroads, U.S. rail carload traffic increased by 1.1% for the week ending March 19th, while intermodal volume decreased by 5.7% year-over-year. Year-to-date, cumulative carload traffic is up 3%, but intermodal volume is down 7.1%. The overall trend in North American rail freight indicates a decline, highlighting supply chain challenges and regional interconnections. This divergence between carload and intermodal performance suggests shifts in freight patterns and potential bottlenecks within the broader logistics network.