Amazon Handmade Expands Amid Ecommerce Craft Boom

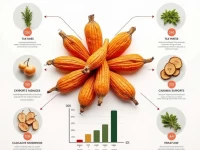

This article delves into the opportunities and challenges within the Amazon Handmade category, analyzing its sales distribution characteristics and competitive landscape. It emphasizes the importance of independent thinking and antifragile mindset, and proposes strategies for refined operations and differentiated competition. The aim is to help sellers realize creative monetization within the Handmade category. This includes carefully selecting products, understanding the target audience, and implementing marketing strategies tailored to handmade goods. By focusing on quality and unique offerings, sellers can thrive in this niche market.