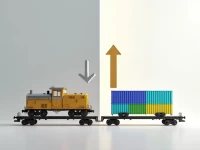

US Rail Freight Automotive Grain Up As Intermodal Lags

The Association of American Railroads (AAR) reported a mixed performance in U.S. rail freight for the week ending March 21. Traditional carload traffic saw a slight year-over-year decrease, but grain and automotive shipments performed strongly. Intermodal volume, however, bucked the trend and increased. Year-to-date figures show a small increase in carload volume, while intermodal volume experienced a slight decline. The U.S. rail freight market is undergoing a transformation and upgrade, requiring proactive responses to challenges and the seizing of opportunities.