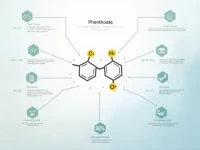

Global Fenpropathrin Market Trends and HS Code Insights

This article examines the HS code (2903590010) for toxic fungicide and its relevant tax rate information, highlighting its significance for import and export enterprises. It also provides practical analysis of market dynamics.