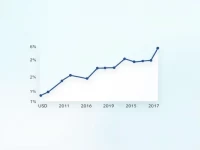

Cayman Dollar Gains on US Dollar As Markets React Positively

The Cayman Islands currency KYD has experienced a slight increase against the USD, now standing at 1.2195, indicating market volatility. This change not only impacts the financial landscape of the Caymans but also raises attention on foreign trade and investment. Experts emphasize that investors should closely monitor exchange rate fluctuations to promptly adjust their investment strategies.