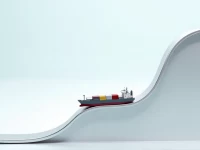

Prologis Report Hints at Logistics Real Estate Recovery

The Prologis IBI Index indicates a turning point in logistics real estate demand, with net absorption and new lease signings exceeding the 2024 average, signaling market recovery. Demand is driven by e-commerce growth, supply chain resilience, and efficiency improvements. However, attention should be paid to the impact of macroeconomic factors, geopolitical risks, and technological changes. The future development of the industry relies more on innovation and sustainability. Significant regional differences exist, requiring comprehensive market analysis.