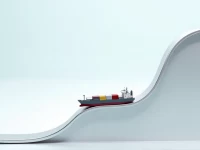

Retail Recovery Spurs Warehouse Demand Amid Supply Chain Shifts

A Prologis report indicates a surge in demand for warehouse space driven by retail recovery and supply chain reshaping. The IBI index has reached a record high, vacancy rates have fallen to pre-pandemic levels, and strong rental growth is expected. Businesses should plan ahead and embrace intelligent, three-dimensional, shared, and green warehousing models to address these challenges. The increased demand highlights the critical role of efficient warehousing in supporting both the evolving retail landscape and the restructuring of global supply chains.