Global Currency Exchange Rates Shift in Early 2026

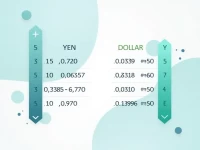

This article provides an authoritative interpretation of the RMB, RUB, USD, and EUR exchange rates as of January 21, 2026. It integrates data from the Central Bank of Russia and China UnionPay to analyze exchange rate differences and provides links to official data sources. Readers are advised to refer to the information rationally, considering real-time exchange rates for informed decision-making. The provided data serves as a reference point, and users should always consult the most up-to-date information before making any financial decisions.