Mastering The Import Customs Clearance Process 7 Key Points To Ensure Smooth Customs Clearance

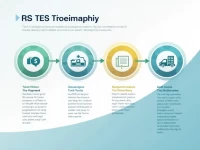

This article explains the key steps in import customs clearance, including the processes and precautions for general trade and processing trade. It provides detailed information about payment methods, necessary documents, bill exchange, quality inspection, customs declaration, tariff payment, and release steps to assist businesses in successfully completing import procedures.