How To Properly Fill In The Transaction Method In The Export Customs Declaration?

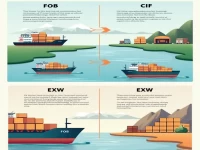

This guide provides detailed instructions on how to correctly fill in the 'Transaction Terms' section of the Export Goods Customs Declaration. It outlines the steps and considerations for various international trade terms such as FOB, C&F, and CIF. This not only helps improve customs efficiency but also reduces transaction risks, making it an essential reference for anyone engaged in international trade.