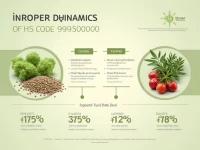

New Initiative Aims to Boost SME Global Trade Access

The report calls on customs administrations worldwide to simplify procedures and remove barriers hindering SMEs' participation in global trade. This aims to promote their integration into the global trading system and build a more resilient future for trade. Streamlining processes and reducing complexities will empower SMEs to engage more effectively in international commerce, fostering economic growth and diversification. The report emphasizes the importance of creating a level playing field where SMEs can compete and contribute to a robust and inclusive global economy. The AEO program is highlighted as a key tool for facilitating trade and enhancing security.