Shipping Guide China to Malaysia by Sea Air and Express

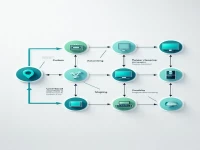

This article provides an in-depth analysis of various shipping methods from China to Malaysia, including international express, air freight, and sea freight. It details key factors to consider when choosing a shipping method, such as the type of goods, volume/weight, delivery time, and budget. The article also introduces the necessary customs clearance documents and precautions, aiming to help Chinese sellers find the most suitable cross-border logistics solution for their specific needs.