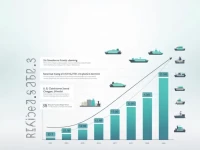

US Raises Heavy Truck Tariffs Sparks Industry Cost Worries

The US imposed a 25% tariff on imported heavy trucks, aiming to revitalize domestic manufacturing. However, this could lead to higher truck prices, increased transportation costs, and potential trade wars. The impact on the trucking industry and freight carriers is significant, requiring businesses to closely monitor policy changes and take countermeasures. The future direction of the policy remains uncertain. This action has far-reaching consequences for the entire supply chain and could ultimately affect consumer prices as well.