Indonesian Rupiah Weakens Against US Dollar Amid Economic Shifts

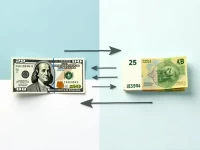

This article examines the exchange rate and trends between the Indonesian Rupiah (IDR) and the US Dollar (USD), currently valued at 5 IDR to 0.00003073 USD. Understanding the dynamics of currency conversion is crucial for financial decision-making for both individuals and businesses.