Norwegian Krone to USD Trends and Risk Management Insights

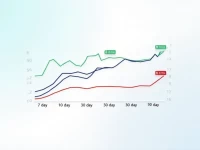

This article provides an in-depth analysis of the Norwegian Krone (NOK) to US Dollar (USD) exchange rate, offering a real-time conversion tool, historical trend analysis, and risk management advice. It focuses on factors influencing the exchange rate, such as crude oil prices, interest rate policies, and the global economic situation. Practical tools and resources are provided to help users make informed decisions in cross-border transactions. The analysis aims to equip individuals and businesses with the knowledge needed to navigate the NOK/USD exchange rate effectively.