The exchange rate between the Japanese yen and the U.S. dollar has emerged as a focal point for investors amid heightened global economic volatility. Recent data indicates that 1 Japanese yen currently trades at 0.00679066 U.S. dollars , equating to approximately 147.261 yen per 1 U.S. dollar .

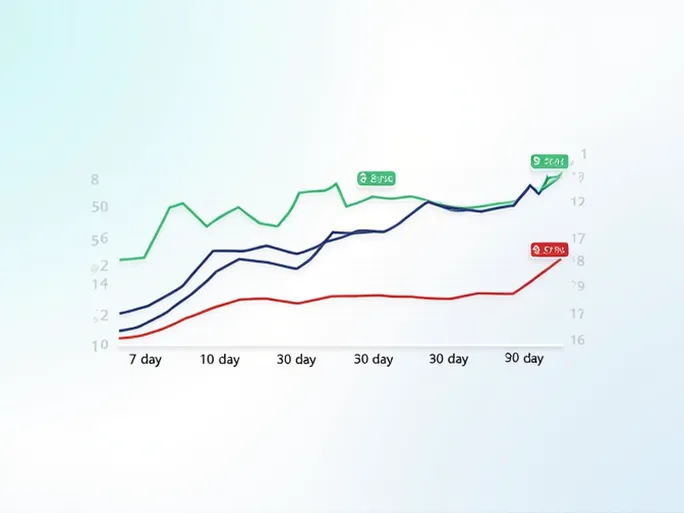

Market observers have noted significant fluctuations in the currency pair over recent periods. During the past seven days, the exchange rate reached a high of 0.0068125 dollars per yen and a low of 0.0066312 dollars . The 30-day and 90-day windows show broader ranges, with peaks at 0.0068548 and 0.0070210 dollars respectively, while the seven-day low of 0.0066312 dollars represents the floor across all observed timeframes.

Statistical analysis reveals the seven-day average stands at 0.0067586 dollars with 1.05% volatility , while the 30-day and 90-day periods demonstrate lower volatility at 0.62% and 0.57% respectively, with averages of 0.0067734 and 0.0068661 dollars .

Beyond exchange rate movements, market participants continue to assess the yen's liquidity and trading volume. The currency pair (¥/$) maintains strong demand in global markets, reflecting its significance in international finance.

Analysts attribute recent exchange rate dynamics to multiple factors, including monetary policy decisions by the Bank of Japan, evolving international trade conditions, and broader global economic trends. Potential additional economic stimulus measures from Japanese policymakers could further influence the yen's trajectory. Geopolitical developments and the pace of worldwide economic recovery remain additional variables affecting currency fluctuations.

Financial experts recommend close monitoring of yen-dollar exchange rate movements to identify strategic opportunities. While current volatility presents both challenges and possibilities, comprehensive analysis incorporating diverse market factors remains essential for informed decision-making.