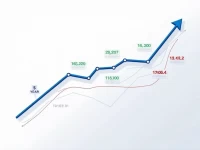

USD to IDR Exchange Rate Trends Impact Investment Strategies

This article analyzes the latest exchange rate dynamics of the USD against the Indonesian Rupiah, currently at 1 USD = 16,243.8 IDR. It highlights the significance of exchange rate fluctuations for investors and aims to assist them in seizing market opportunities.