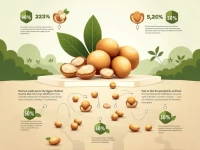

Export HS Codes Clarified for Nonthreatened Meat Products

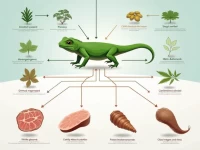

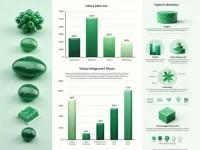

This article analyzes the HS codes related to non-threatened reptile meat and other dried, smoked, and salted meats, along with their export tax refund policies. It emphasizes the importance of correctly applying HS codes to assist exporters in better navigating market challenges.