Egypts Central Bank Issues SWIFT Code Guide for Global Transfers

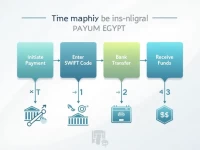

This article provides the SWIFT codes and detailed addresses for the branches of the Central Bank of Egypt, guiding users on cross-border transfers. It also highlights the advantages of using Xe for money transfers, including the best exchange rates and low fees, while reminding readers to be cautious about error checking in SWIFT payments.