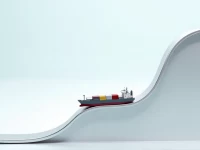

US Rail Freight Carloads Rise Container Traffic Slows

Recent data reveals a divergence in the US rail freight market: railcar loadings are up year-over-year, with strong performance in coal, grain, and nonmetallic minerals. Conversely, container traffic has declined, potentially influenced by slowing global trade and port congestion. Despite short-term fluctuations, cumulative data for the first 49 weeks of 2025 suggests a positive long-term trend for rail freight. Facing both challenges and opportunities, rail transportation companies must monitor market changes and adapt their business strategies accordingly.