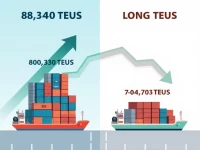

Global Container Shipping Rates Drop Amid Economic Uncertainty

Container shipping rates continue to decline due to weak demand and supply-demand imbalances. In the short term, rates may decrease further; however, seasonal demand recovery in the second quarter could provide support for rates. At the same time, uncertainties in the global economic landscape and trade policies will continue to influence market trends.