ASB Bank Clarifies SWIFT Code Usage Guidelines

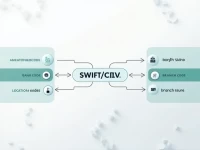

The SWIFT code for ASB BANK LIMITED is ASBBNZ2A XXX, ensuring the accuracy and security of international remittances. It is crucial to verify the SWIFT code when conducting cross-border transactions to avoid any errors in fund transfers. Understanding this information will help ensure that funds are transferred smoothly.