Truckload Index Highlights Profit Tactics in July Freight Slump

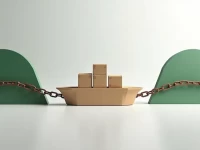

The July DAT Truckload Volume Index indicates a freight market influenced by seasonality, with declining rates and excess capacity. Experts recommend monitoring market data, optimizing costs, implementing flexible pricing, and enhancing service quality. Proactive transformation is crucial to prepare for market recovery, seize opportunities, and achieve sustainable growth. Focus on data-driven decisions and strategic adjustments to navigate the current challenges and position your business for future success in the evolving freight landscape. Staying agile and informed will be key to weathering the downturn and capitalizing on the eventual rebound.