90s Freight Forwarder Thrives with Online Learning Adaptation

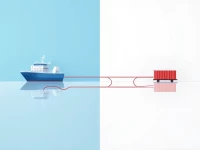

This article focuses on Xia Xiaozheng, a 90s freight forwarder, and his learning and growth on the Consolidation Handbook platform. By analyzing his interaction patterns, it showcases his proactive learning and helpful spirit. The article also expands on key knowledge points such as customer-owned containers and equipment interchange receipts. Furthermore, it provides practical advice for new freight forwarders, encouraging them to continuously learn, accumulate experience, and ultimately achieve success in the industry. The case study highlights the importance of continuous learning and community engagement for newcomers in the freight forwarding industry.