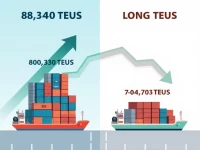

Transpacific Shipping Rates Drop but Stay Above 2022 Levels

Although the trans-Pacific ocean freight container rates are on a downward trend, they remain approximately $1,000/FEU higher compared to the same period last year. The calm period after the Spring Festival has led to a price decline, and it is expected that as service models return to normal, contract rates will decrease.