Amazon Sellers Face Suspensions Over Repeat Policy Violations

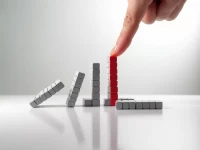

Amazon's 'Account Health Rating' policy update highlights repeated violations as a high-risk factor for account suspension. Sellers must comprehensively investigate potential infringement risks, promptly address violation warnings, standardize order processing and customer reviews, and implement measures to prevent account association. Compliant operation is fundamental to survival on Amazon. Proactive risk management and adherence to Amazon's policies are crucial for maintaining a healthy account and avoiding penalties. Failure to comply can lead to severe consequences, including account suspension or termination. Therefore, sellers should prioritize compliance to ensure long-term success on the platform.