Logistics Firm NPE Guarantees Faster Europeuk Shipping

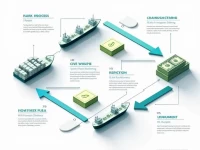

NPE's dedicated European and American line has been significantly upgraded, boosting speed and efficiency. We offer both express delivery and truck delivery options, along with dual-track logistics solutions including tax-inclusive and tax-exclusive services. Our professional team ensures efficient customs clearance, supported by a global transportation network and overseas warehousing. We are committed to providing customers with efficient, convenient, high-quality, and secure one-stop cross-border logistics services. We are focused on optimizing supply chain performance and exceeding customer expectations.