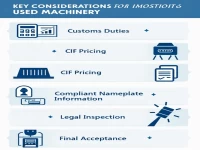

US Pistachio Exporters Face New HS Code Tariff Challenges

This article provides a detailed overview of the HS code 0802500000 for pistachios (Pistacia vera). It analyzes the relevant export and import tax rates, highlighting key factors and policies that should be considered in the import and export processes. This serves as a practical reference for parties engaged in trade within this sector.